Table of Contents

Structured Finance

Structured Finance basically encompasses all advanced Private and Public financial arrangements that serve to efficiently refinance and hedge any profitable economic activity beyond the scope of conventional forms of balance sheet securities in the effort to lower cost of capital and to mitigate costs of market impediments on liquidity.

In simple terms it is used to describe a sector in finance that is used to transfer risk.

What is Securitization ?

Securitization is the practice of pooling in various types of debts and selling the consolidated debts to various investors. There is a principal and interest on the debt which is paid to various investors on a predefined basis.

Securitization applies to assets which are illiquid and are basically used to maximize cash flow and reduce risk. This process is mostly used in the real estate industry where it is applied to the pools of leased property, besides it is used in the lending industry, like home loans, student loans, vehicle loans and other debts.

Any asset can be securitized as long as they are associated with steady amount of cash.

Process of Securitization

- Borrower originates loans such as to a home owner or corporation

- Borrowers’ loans are aggregated and pooled to form a pool of assets which can be securitized

- Securitization structure is added by the bank who sells or assigns certain assets to a special purpose vehicle

- The structure is legally insulated by the management

- Credit enhancement and rating agencies review the structure and assign ratings on the same

- The SPV issues debt, dividing the benefits and risks, and issues them to the investors

- Investors buy the debt based on the credit ratings

Important Players in the Securitization process

- Originator: Such as mortgage lenders and banks who initially create the assets to be securitized

- Aggregator: Purchases assets of a similar type from one or many originators and pools them together

- Depositor: Creates the Special Purpose Vehicle for the securitized transaction. The depositor acquires the pooled assets from the aggregator and in turn deposits them into a special purpose vehicle.

- Issuer: Acquires all the pooled assets and issues the certificates which are eventually sold to the investors. One difference is that issuer does not directly issue to the investors, the issuer conveys the certificates to the depositor in exchange for the pooled assets. In simple terms the issuer is the SPV which finally holds the pooled assets and acts as a conduit for the cash flows of the pooled assets.

- Investors: Purchase the SPV issued certificates, each investor is issued a monthly payments of Principal and interest from the SPV. Depending on the type of tranche the investor has invested the interest rate, priority and other payment rights differs.

- Trustee: Trustee is appointed to oversee the issuing SPV and protect the investors by calculating the cash flows from the pooled assets and by remitting the SPV net revenues to the investors as returns.

- Servicer: The party collects the money due from the borrowers under each individual loan in the asset pool. The Servicer remits the collected funds to the trustee for distribution to the investors. These Servicers are entitled to collect fees for servicing the loans.

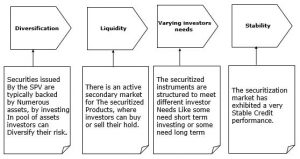

Why invest in Securitized Instruments?

Major Investors in Securitized instruments

The large and sophisticated investors normally invest in securitized instruments like:

A) Private pension funds

B) Government pension funds

C) Government agencies

D) Insurance companies

E) Mutual funds

F) Government agencies

G) Credit unions

Special Purpose Vehicle

Meaning:

Special purpose vehicle is a legal entity which is created to fulfill a narrow or a specific objective. They are basically used by companies to isolate the firm from financial risks.

They are commonly used to hide debt, ownership and obscure relationship between different entities.

Uses:

- Risk Sharing: A Company normally will transfer assets to a SPV for management or use the SPV to finance a large project there by achieving the goals without putting the firm at risk

- Asset Transfer: Some assets (E.g. Power Plants) are non transferable or have too many norms to be transferred, but through an SPV it can be sold in a self contained package

- Financial reengineering: Normally organizations use SPV for financial re-engineering schemes, whose main goal is avoidance of taxes or manipulation of financial instruments

- Property Investing: Some countries have different tax rates for capital gains and gains from property sales. For tax benefits, letting each company to be owned by a separate company, can be useful, these companies can then be bought or sold instead of actual properties, effectively converting property sale gains into capital gains for tax purpose.

Special Types of Securitization

- Master Trust: is a type of SPV which is used to handle credit card balances and has the flexibility to handle different securities at a time. In a normal Master trust transaction, an originator of the credit card receivables, transfers a pool of those receivables to a trust then the trust issues securities based on these receivables to the investors.

- Grantor trust: Grantor trusts are typically used in the automobile basked securities. An originator pools together all the loans on automobiles and sells them to Grantor trust which issues classes of securities backed by these loans. Principal and interest received on these are taken into account and are passed on to the holders of the securities on a pro-rata basis.

- Owner Trust: In an owner trust, there is more flexibility in allocating interest and principal to different classes of issued securities. i.e. interest and principal due to subordinate securities can be used to pay the senior securities. Due to this reason, owner trust can customize the maturity, risk and return of the issues, securities to the investors needs.

Credit Rating Agencies

- A credit rating agency assigns credit rating for issuers of debt obligations as well as the debt instruments themselves. The issuers would normally be companies, SPVs, state and local governments which issue debt like securities that can be traded in the secondary markets and non profit organizations etc.

- A credit rating for an issuer, takes into consideration the issuers’ credit worthiness and affects the interest rate applied to that particular security being issued

- Credit ratings are given not only to organizations but also to individuals. Based on the individual job profile and income, a rating will be given by Credit Bureau (US) and Consumer credit Reporting agency (UK) so that an individual credit worthiness can be assessed

- Credit ratings are used by Investors, Issuers, Investment banks, Broker/Dealers and Governments. For Investors, credit ratings agencies use a range of investment alternatives and provide independent measurements to assess credit risk.

Uses of credit rating

- Ratings used by Bond issuers: Issuers rely on credit ratings as an independent verification of their own credit worthiness and the resultant value of the instruments they issue. In most cases, for a bond issuance, it must have at least one rating from a respected rating agency. If there is no rating, the issuance may be under-subscribed by the investors.

- Ratings used by Government regulators: Regulators use credit ranking for the calculation of the net capital reserve requirements. Bank regulators use credit ratings provided by the credit rating agencies. In the US, SEC permits investment banks to use ratings from nationally recognized statistical ratings organizations. Also, the US SEC permits certain bond issuers to use a shortened prospectus form when issuing bond, if the issuer has issued bonds before and has a credit rating above a certain level.

- Ratings used in Structured Finance: Credit ratings also play a crucial role in structured finance transactions. Unlike a typical loan or a bond issue, structured financial transactions are viewed as a series of loans with different characteristics or a small number of loans of a similar type packaged together into a series of buckets or tranches. Here, credit ratings are used in determining the interest rates based on the particular tranche, quality of loans or the quality of assets present in that group.

Eg: A bond with AAA or Aaa rating is supposed to be high grade bond with a very less chance of default, so the interest rates on these bonds will be low.

A bond with DDD or D rating is supposed to be highly risky, where the interest rates given for the investor will be high & the chances of default of these bonds are also high.

List of credit rating agencies

The big three – Standard and Poor’s

Moody’s Investor Services

Fitch Ratings

Other rating agencies are:

- A.M Best

- Baycorp Advantage

- Capital Intelligence

- Credo Lin

- Dagong Global

- Dominion bond rating services

- Egan Jones rating company

- Rapid rating international

- Muro’s ratings

- Japan credit rating agency limited

Ratings Details

- AAA or Aaa Extremely strong capacity to meet financial commitments

- AA+ or Aa1 VERY STRONG capacity to meet its financial commitments. It differs from the highest rated obligors only in small degree.

- A2 or A STRONG capacity to meet its financial commitments but is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions

- BBB to B More vulnerable but the obligators have the capacity to meet its financial commitments

- CCC to C Currently vulnerable to the economic conditions and there are chances of non payment

- NR No ratings have been requested

Tranche

It is one of the number of related securities offered as the part of the same transaction. Tranches are created based on classes like Class A, Class B or Class C securities with different credit ratings.

Interest payments depend on the type of tranche the instrument belongs to like AAA or C etc i.e. Interest will be paid off for AAA first and C last.

In case of loss, the lowest tranches absorb the loss first and will impact the Higher Tranches at the last

Yields for higher tranches will be lesser as compared to yields for the lower tranches.

Example for Tranches

A SPV sells 4 tranches of credit linked notes with the below structure:

- Tranche D: Is the lowest among the ratings and if there are defaults this tranche will accept first 25% of the losses on the portfolio and is the most risky

- Tranche C: Is better than Tranche D in ratings, but in case of default after Tranche D, Tranche C will accept the next 25% of loss

- Tranche B: Is better than Tranche D and C in ratings, but in case of default after Tranche D and C, Tranche B will accept the next 25% of loss

- Tranche A: Is the last and has the highest rating, but in case of loss, Tranche A will be the last one to be affected.

Benefits & Risks of Tranching

Benefits:

- Can create one or more classes of securities

- Ratings can be averaged

- Diversify risks

- Investor can diversify their portfolios

Risks:

- Lead to complexity of deals with involvement of too many parties

- As the complexity increases, the less sophisticated investors will not be able to understand and will be unable to make an investment decision

- Based on the historical performances, some of the tranches may be just overrated

- If there is a default, the tranches may have conflicting goals leading to expensive time consuming law suits

Hybrid Security

Is a broad group of securities that combine two broader group of securities. i.e. debt and equity. These securities pay a fixed income up to certain point of time along with an option to convert the securities to shares. So the investor will have a fixed income until sometime unlike an equity stock and can be converted to equity and reap benefits based on the prices, unlike a fixed income security.

E.g. : A convertible bond is a bond that can be converted into common shares of the issuer.

The important hybrid instruments are:

a. Preference shares

b. Convertible/ exchangeable debentures/bonds

c. Debt with attached warrants

Important Terms under Hybrid Securities

- Returns: Predictable dividends, possible tax advantage on the same

- Capital price:

- Price associated with share price

- Bond, like price, is based on face value

- Discount: is offered on the share price at the time of conversion

- Reset date: On the reset date, terms of the security (Dividend rate, next reset date) may change; if user wants to accept he can else it can be converted to shares

- Once the contract is expired investor can get two types of shares:

- Redeemable shares: Investor may have the option to sell the shares back to the company at the face/issue price

- Non Redeemable shares: Investor cannot sell the shares back to the organization, but can trade them off at the exchange

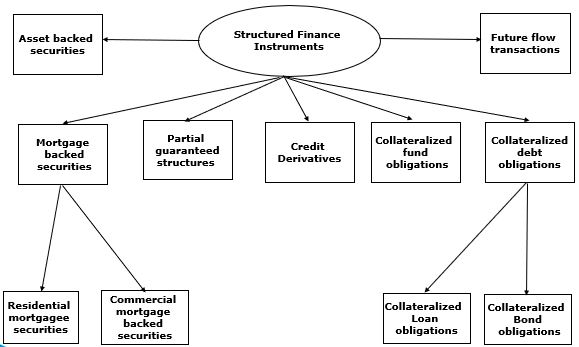

Types of Structured Finance Instruments